In international trade statistics and classification systems (like HS, SITC, or CPC), “N.E.S.” or “nes” or “Nes” stands for:

👉 “Not Elsewhere Specified” 🔍 What it Means: It’s a catch-all category for items that:

- Don’t fit neatly into the existing detailed classifications

- Are miscellaneous or residual goods in that group

- May be too specific or uncommon to have their own sub-code

📦 Example: “Non-Metallic Mineral Manufactures, NES” might include:

- Unique construction materials

- Specialized ceramic items

- Non-metal mineral products not classified under other standard codes like glass, cement, or stone

So in the dataset, “NES” just means it’s a miscellaneous category for that commodity group.

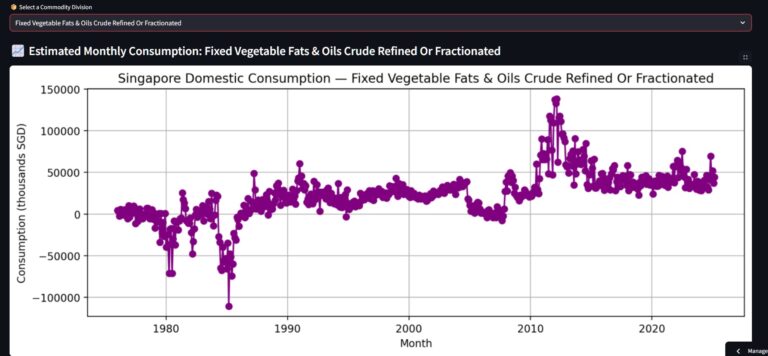

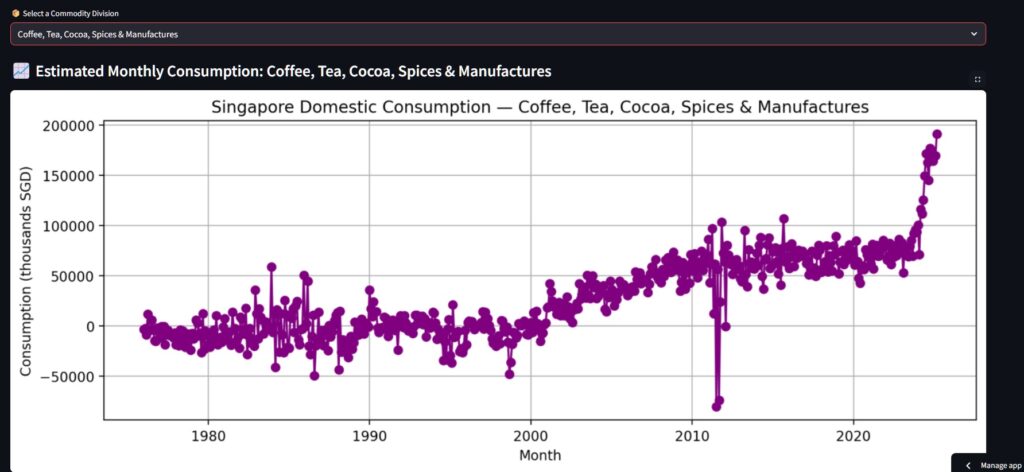

Insights

Edible oils (Fixed Vegetable Fats & Oils) show volatile trends with large spikes and drops, but since 2010 the average monthly consumption appears to have stabilized at higher levels than pre-2000, indicating moderate to increased usage over time.

Coffee, Tea, Cocoa, Spices & Manufactures show a clear upward trend, especially after 2010, with a strong spike in recent years — strongly suggesting growing consumption habits among Singaporeans for these products.

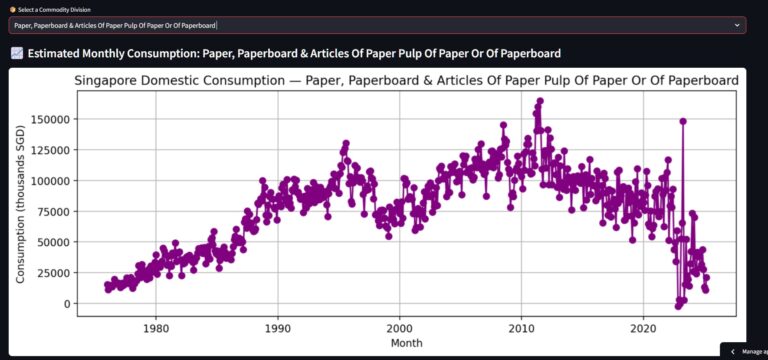

Aligning with digital and environmental trends.

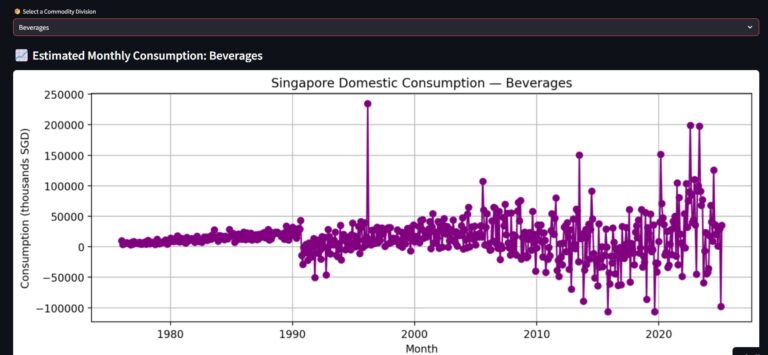

The chart suggests potential stagnation or even decline in Singapore’s domestic beverage consumption, especially in recent years.

Key signs:

⚠️ Heavy fluctuations and sharp negative values (post-2010), possibly indicating: Inventory re-exports exceeding imports (e.g., re-exporting stock) Seasonal dumping, corrections, or trade anomalies

📉 Lack of clear growth trend post-2015—consumption appears more volatile and flat, if not declining

📊 Compared to pre-2010: earlier decades showed steadier or moderate growth

Possible factors: Market saturation Shift to healthier or alternative drinks Export-driven beverage trade (less local use) So yes, unless corrected, this data may imply lower domestic beverage demand, or at least more erratic patterns going forward.

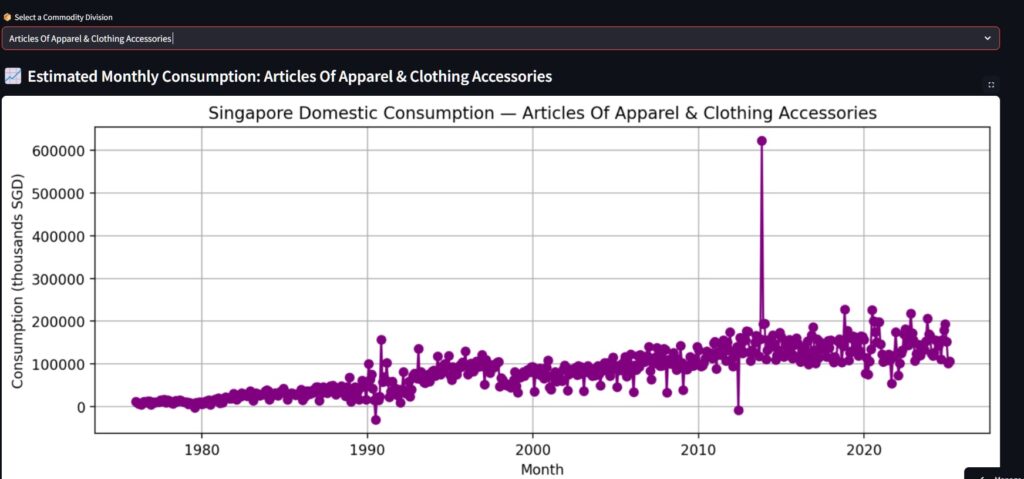

The Singaporean net domestic consumption is modest and stable, but masked by high re-export flows and global supply chain roles.

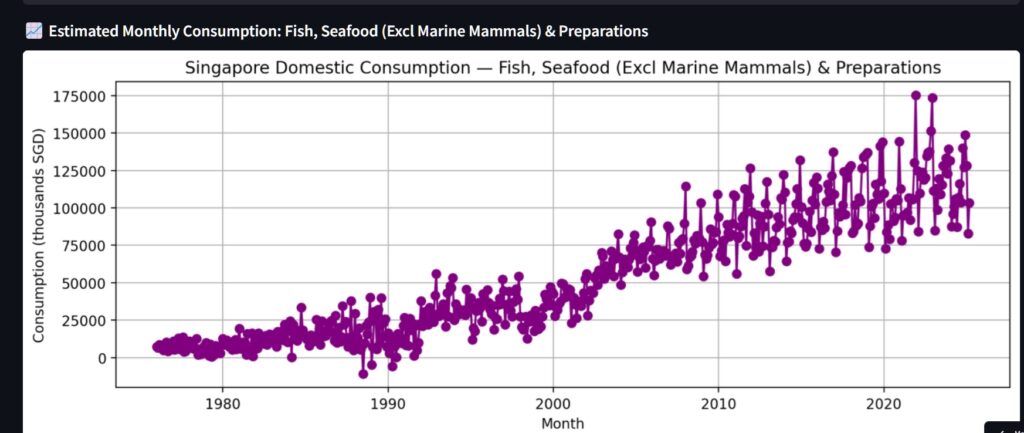

The chart strongly suggests that Singaporeans have been consuming more fish and seafood over time.

Key observations:

📈 Long-term upward trend in domestic consumption from the 1980s through 2020s.

📊 Especially sharp growth after the early 2000s, possibly due to population growth, dietary shifts, or improved trade access.

⚠️ The spikes and volatility in recent years could reflect seasonal demand, stockpiling, or supply chain shifts (e.g., during COVID).

So yes, the data supports that internal demand for fish and seafood has increased significantly.

🧮 Data Source

MerchandiseImportsByCommodityDivisionMonthly.csvReExportsByCommodityDivisionMonthly.csv